This is an interesting read about where the way we pay/get paid is headed…http://money.cnn.com/2016/02/10/technology/daily-paychecks/index.html

Posted by The Money Game on Sunday, February 14, 2016

Category Archives: Penny-Wise

Extreme Gaming…

How little can you live on?

Me? Very little. This is what my monthly bills work out to:

Rent: $ 400.00

Groceries: 150.00

Vehicle Insurance: 95.00

Life Insurance: 15.00

Bank Fees: 15.00

Phone/Internet*: 100.00

Netflix*: 8.00

Automatic Savings: 50.00

Gas: 100.00

Money Challenge: 115.00

(Averaged)

Van Maintenance: 25.00

(Averaged)

_________

$ 1073.00

That’s it – bare bones.

So, that’s all well and good for me, assuming I bring in more than $1075 (or approximately $540 bi-weekly). Easy Peasy, right?

Yes. So long as I’m not in debt.

Which I am. Again.

(but “just a little bit”) LOL! Listen to me; trying to make excuses!

I assume, generally, that if I’m working full-time, even at minimum wage, that I can bring in an average $750 in take-home pay bi-weekly – or $1500 a month.

My debt is with 2 credit cards. 1 card has substantially more debt than the other; it also has a much higher interest rate.

According to The Rules of the Credit Card, I can’t use either of these cards – at all – until the debts are paid down. Then, I can only use them as a “money tool” – they can’t cost me money to use, they should save me money in some manner by using them, and/or, better yet, they should earn me money somehow.

All of my “extra” money – money earned that is not ear-marked for bare-bones expenses (stuff I can’t or won’t live without), will be thrown at that debt until I kill it.

So, if I take home, on average, $1500 monthly and my bare-bones expenses total $1075, my so-called “extra” money comes out to about $425. This is what I’m going to throw at my debt every month: $300 will go on the card with the lowest balance – because it will be paid off really quickly, and that will make me feel like I’m getting somewhere. It helps to feel like you’re winning when playing The Money Game, believe me.

Check out this screen shot:

So I’m looking at 9-10 more months paying this debt down and then I’ll be moving on (again) to investing in Pre-paid Living. That is a whole ‘nother kind of Money Game!

***

P.S. That Credit Card Calculator is available to use for free HERE.

P.P.S. *I WILL NOT live without Netflix OR the Internet!

Tangerine Bank and Your Savings Goals…

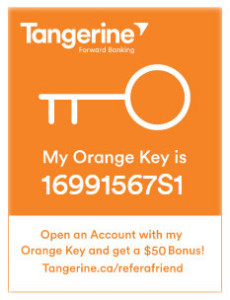

Open an Account using my Orange Key and receive a $50* Bonus!

Open an Account using my Orange Key and receive a $50* Bonus!

I want you to experience Forward Banking™ with Tangerine. You can save on fees, earn great interest, enjoy cash Bonuses and take charge of your money.

Open a Tangerine Account – any type of Account – by March 31, 2015 with a minimum deposit of $100 using my Orange Key (16991567S1) and earn a $50 Bonus*. Plus, get an additional $25 Bonus** when you set up an Automatic Savings Program (ASP) into a Tangerine Savings Account with a minimum $100 per month for 6 continuous months! Simply set the amount and frequency you want to save and the ASP moves your money into your Savings Account automatically.

My Orange Key is: 16991567S1

All you need to do is enter my Orange Key when you are opening your Account on tangerine.ca. Or visit Tangerine to learn more and start saving today!

I’m working on the referral for the U.S. version – will update when info is available.

New Year, More Money, Better Habits…

Happy 2015!

Have you made a few “Money Resolutions” for this year?

Will you get out of debt (or finally begin to)?

Will you save more? Spend less?

There are so many great ideas to adopt this year that I’ve been hard put to make many rock-solid resolutions for my money, but I have managed to cement a few.

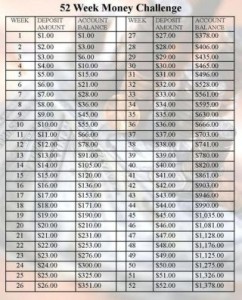

The one really important one to me this year is the “52 Week Money Challenge”. I tried this last year and failed miserably.

Here’s how it’s supposed to work:

In Week 1, you save $1. In Week 2, you save $2. Increase the amount by 1 dollar every week and on the last week of the year, your final “payment” will be $52. If you do this every week during 2015, you will have saved $1,378, not counting any interest you might accrue, depending on where you put that money.

Last year, when I tried this, I worried that I’d give up well before Week 52 for several reasons, the biggest one being that I get paid bi-weekly, so I’d actually have to save $3 out of my paycheck instead of $1, which meant that by the last week of the year, I’d be looking at putting aside not $52, but a whopping (for me) $103. I don’t have a very good “savings” record.

Because of this, in 2014, I decided to work backwards, thinking it would be easier to do if I started at the higher amount every week and worked my way down. This should have worked, but all it did for me was make me give up sooner – as in, I failed at Week 3. I also pulled out the $103 I put away at Weeks 1 and 2 before I finished January, and spent it on I don’t even remember what.

In my head, this “backwards version” of the Money Challenge still seems like the best method for me, but I already know my own money weaknesses, and I’m pretty sure this isn’t going to work. Again.

Another thing that picks at my brain in a very bad way, is that $1,378 in savings for an entire year just strikes me as lousy. It’s really difficult for me to stop that crappy thinking and remind myself that $1,378 saved in a year is a helluva lot better than $0 saved.

So in 2015 I’m turning over a new leaf in Money-Thinking. Any amount of money saved, especially left untouched for an entire year is going to be a very big win for me, even if it’s “only” $1,378 + interest.

I’m challenging myself again, but going the forward route. My plan is to work toward saving more as I go along by slowly but surely cutting back on money I might normally piss away on stupid things.

Like cigarettes.

Like coffee at the mall.

Like whatever mystery purchases the little bits and bobs of cash I sometimes have in my pocket get spent on.

I have a high-interest, tax-free account set up to transfer my money into and this morning, I made my first payment of $3 into it. Add that to the $10.05 I already had in there (YAY! 5 cents of that is accrued interest!! FREE MONEY!!!), and my current TFSA balance is a whopping $13.05.

Sounds a little piddly, doesn’t it?

Sure does.

But it’s $13.05 that I didn’t have to my name before I opened that account.

If I really need it, I can get at that money instantly, but a fee applies (that’s where the tax on the money gets paid – only if I take it back out of there), so it will actually cost me money if I access the account. Hopefully, this will make me think twice before I transfer anything out.

I also challenge YOU to do the 52 Week Money Challenge with me.

You can print out this pdf grid from affinityplus.org to help you stay on track. There are also free apps available for Android and Apple users. I’ll post a bi-weekly update on how I’m doing as well. What have you got to lose? Absolutely nothing – but $1,378+ in a savings account by December 2015 is a definite gain, isn’t it?

The other thing I’ve resolved to do this year is earn more money. I’ve never much cared that I’ve worked a minimum wage J.O.B. for all of my adult life. I don’t travel very much, I drive a 22-year-old vehicle that’s paid for that I plan to drive til it dies, and I can get by alright on what I earn.

The down-side to this is that my savings habits suck. I tend to use credit cards for major purchases, which means I can’t always pay the entire balance on a card each month, and so I pay more for that item in interest charges. That kind of takes away any “great deal cuz it was on sale” pride I could be feeling (Don’t kid yourselves, people – it’s not a great deal if you’re still paying it off months later!).

I also have no pension plan in my J.O.B. – nor will I ever get a raise beyond the minimum wage, because although I’m paid on an hourly basis, I’m a commissioned salesperson. I can earn more per paycheck by selling more, but that’s all…

So, why not quit this lousy-paying minimum wage job? Well… because I love this job. And my customers. And my co-workers. I also don’t have the formal education to quit and get a better-paying job in this economy (or the drive and available funds to go back to school – if I had the drive, I’d somehow get the funds… but…).

So how can I earn more money in 2015?

1) I can sell more, can’t I? So…

My 2015 Resolution for my J.O.B. is to earnestly attempt to hit my commission quota every pay period, rather than just depend on my regular paycheck + whatever bits of commissions/spiffs I might “happen” to make.

2) I can add to my streams of income through my affiliate marketing partnerships. This sounds good – but I do tend to sign up for new partnerships that I then don’t actually promote much. I must fix that if I’m going to make those streams pay more this year. So…

My 2015 Resolution for my Affiliate Partnerships is to choose three partnerships I truly love to sell, and promote them regularly on Facebook, through my Affiliate Newsletter to build downlines (sign up HERE for free!), my blogs and through both free and paid advertising.

3) I can publish more. In 2014, for the first time, I published one of my short fiction stories. I never quite had the guts to do this before, and the feeling I get every time I sell another copy of that story is phenomenal! I want to publish, publish, publish, now…

Can’t do that if I don’t write, though, can I? So…

My 2015 Resolution for my writing career is to actually sit down and write, working on my current project, Every. Single. Day.

And then actually publish it for sale. Then, I’ll start the next project and do the same thing (Pssst! You can read about and/or purchase my (so far) one-and-only published fiction piece HERE.).

4)I can promote my custom designs regularly. I have a Zazzle store called Les Becker Designs that I make the odd sale through, just by having it live online. When I actually bother to promote it, my sales jump by a lot. There’s also a year-round “flea market” here in my hometown called The Mill Market, that I could be utilizing, by ordering my Zazzle products in wholesale and trekking to once a week. There’s a built-in crowd there, I can take credit card payments through Square, and I know people that are already building their businesses there that can help me learn the ropes – I can even sell my stories digitally there! So…

My 2015 Resolution for Les Becker Designs is to promote it regularly through its Facebook page, as well as sell my products at Sault Ste. Marie’s Mill Market.

5) I can turn my hobbies into money through Etzy. I love to sew, knit, crochet, sculpt – you name it. I don’t do a lot of it lately only because I’ve been actively down-sizing my “stuff”. Crafting adds to my stuff, so what I do make, I can’t generally keep without adding clutter to my space – not to mention the kind of room it takes to store supplies. When I’m actively crafting, I end up making too much to keep or give away, but not enough to open a physical store. This is where Etzy will come in. So…

My 2015 Resolution for my Money-Making Hobbies is to open an Etzy storefront. I’ll be able to craft to my heart’s content without worrying about cluttering up my small space, and start a new income stream at the same time.

I’d love to hear your Money Resolutions for 2015! Will you get out of debt this year? Start a new business? Begin the 52 Week Money Challenge with me?

Let me know in the comments at the bottom of the post!

Save 20% on ESET Multi-Device Security

Save 20% on ESET Multi-Device Security

from December 2-8, 2014

Black Friday Deal – 50% Off All ESET Products!

50% Off All ESET Products! – Cyber Weekend Deal

Save 50% on ESET Smart Security

Save 50% on ESET Smart Security

from November 18-25, 2014!

Save 30% on ESET NOD32 Antivirus

Save 30% on ESET NOD32 Antivirus

from November 11-17, 2014!

Live Below Your Means…

Let’s say you’ve added up all your debts owing, and added up all your income and your take-home pay is actually not enough to cover all your debts as well as your basic needs and necessities.

Let’s say you’ve added up all your debts owing, and added up all your income and your take-home pay is actually not enough to cover all your debts as well as your basic needs and necessities.

It’s time to reassess your basic needs and necessities, here, folks. You are living beyond your means, and that’s likely the main reason you’re looking at all that debt right now. Never mind how you got in this situation, anyway – you’re here now. It’s time to get yourself out.

(this might hurt a little bit…)

These are your actual Basic Needs.

Shelter: You need a roof over your head. Does your income cover your rent or mortgage payment and insurance? If it does, does it comfortably cover the rent or mortgage payment and insurance? Do you even need insurance if you’re renting? I’ll show you how to decide that simply and easily.

Food: You have to eat. And, in my opinion, although there’s nothing wrong with trying to save money by slashing your food expenses, enough (without over-indulging) healthy food is a basic need. You shouldn’t have to try to survive on Ramen and hotdogs because you just can’t afford to eat better.

Clothing: We need to protect ourselves from the elements, but most of us don’t particularly want to wear layers of burlap and rags as a fashion statement. There are varied number of ways to slash your clothing budget and still manage to dress fashionably. That said, having a closet full of clothes you rarely (if ever) wear and continuing to purchase even more clothing is financially irresponsible. I’ll show you how to fix this habit.

Beyond Basic Needs, there are Necessities. These are things that you don’t necessarily need to survive, but that need to be purchased or maintained in order to fulfill your basic needs.

For example, transportation may be a necessity for you. In order to purchase your groceries, you need to get to a store. If you live around the corner from your favorite grocery outlet, you’re already set; but what if you don’t? How do you get to work?

Do you own a vehicle that your current budget can maintain payments on, buy insurance for, and keep it fueled, along with regular seasonal maintenance? If you have trouble with paying any of the bills associated with your vehicle, you need to consider a different, more affordable vehicle, or you need to consider getting rid of it and using public transportation or carpooling.

Another necessity may be your phone – and a lot of people are finding it more affordable to give up a home phone or landline and use a cell phone exclusively.

Internet? Is it a necessity? Maybe… do you require internet access at your home in order to support your Basic Needs? Maybe not? This is an area to mark for reduction in cost or, if you’re really stuck for cash flow, eliminate altogether (temporarily, I swear!). Most folks can access the internet for free at libraries, coffee shops, their place of work or the local mall. You may have to consider sacrificing your home internet connection when you’re first learning to dig your way out of debt – most especially if you have it entirely for entertainment purposes.

A future post will give you a snapshot of my own financial picture when in debt, along with the detailed, step-by-step plan to get me out. You’ll have the chance to play The Money Game along with me, and get yourself out of debt and into a way life that allows you to pay next year’s expenses now.

It’s called Prepaid Living. It will make you feel rich.